Financial Wellness Resources

Put more money back in your pocket with fewer fees, better rates, and free financial one-on-one guidance. As your employer's Financial Wellness Partner, you can become a member of Telcoe and enjoy all the exclusive perks that come with memberships.

Why Telcoe Federal Credit Union Membership Pays Off

✔

Better Rates That Work for You

As a member, you’ll access lower loan rates and higher savings returns than what you can find at most traditional banks.

✔

No Hidden Fees, No Surprises

It’s free to join Telcoe, and we’ve eliminated many of the fees big banks still charge. That means that we’ll never nickel and dime you.

✔

Free Tools and Personalized Support

Get free credit report reviews, one-on-one financial counseling, notary services, and planning tools to help you feel more confident about your money.

✔

Bank Anywhere, Anytime

Bank your way, whether you're on the go or close to home, with local Arkansas branches, access to 100,000+ surcharge-free ATMs, and top-rated mobile and online banking.

Elevate Your Everyday Banking with Telcoe

- We Put Members First: As a member-owned credit union, we answer to you, not shareholders. That means we’re here to support your financial health, every step of the way.

- $0 Joining Fee: Become a member without paying a cent.

- Free Checking Options: Enjoy checking accounts with no monthly fees when you set up direct deposit, use your debit card, and opt into eStatements.

- Lower Loan Rates: Take advantage of member-only rates on Auto, Home, Personal, Equity, and Line of Credit loans.

- Higher Savings Returns: Grow your money faster with better rates on Savings, Money Market, Club Accounts, IRAs, and HSAs.

- Free Financial Resources & Seminars: Build your financial confidence with ongoing webinars, educational events, and personalized support.

- Local, Human Support: Meet one-on-one with a financial coach for free guidance on budgeting, saving, credit improvement, or any other financial goal you may have.

- Nationwide ATM Access: Withdraw cash from over 100,000 surcharge-free ATMs nationwide through the CO-OP and CULIANCE networks.

- Mobile App Access: Manage your money anytime, anywhere with our highly rated mobile app.

Ready to join Telcoe?

Join NowCall Us at: (501) 375-5321

Access to Powerful Financial Tools

No matter where you are on your financial wellness journey, we have tools to help you along the way.

- Financial Calculators

- Budget (Online or Printable) Forms

- On-Demand Financial Webinars

- Telcoe Arkansas Mobile App

- Christmas, Vacation, Emergency Club Savings Account

- Credit Builder Loan

- Higher Earning Quarter Plus Money Market Account

- Certificates of Deposit

- Youth Accounts

- Once a Member, Always a Member. We go with you, no matter if you retire or change employment.

- Schedule a phone appointment with Greenpath

Ready to join Telcoe?

Join NowCall Us at: (501) 375-5321 x270

How to Join

STEP1

Apply Online

Click the button below to start your membership application—it’s quick, secure, and only takes a few minutes.

STEP2

Open a Savings Account

As part of your application, you’ll open a Prime Savings Account. This account establishes your membership.

PATH3

Enjoy Your Perks!

Now you’re all set to take advantage of your membership, including lower loan rates, higher savings returns, and personalized financial support.

★★★★★

I’ve been banking with him for 21 years I’ve always had pleasant experiences. They have always been professional and always willing to help. I moved from Arkansas in 2012 I’ve lived in two other states and I travel a lot. I am still a member of Telcoe federal credit union and I will not bank with anyone else. They are stuck with me for life. Thank you for all you do.

– Petra L., Little Rock, AR

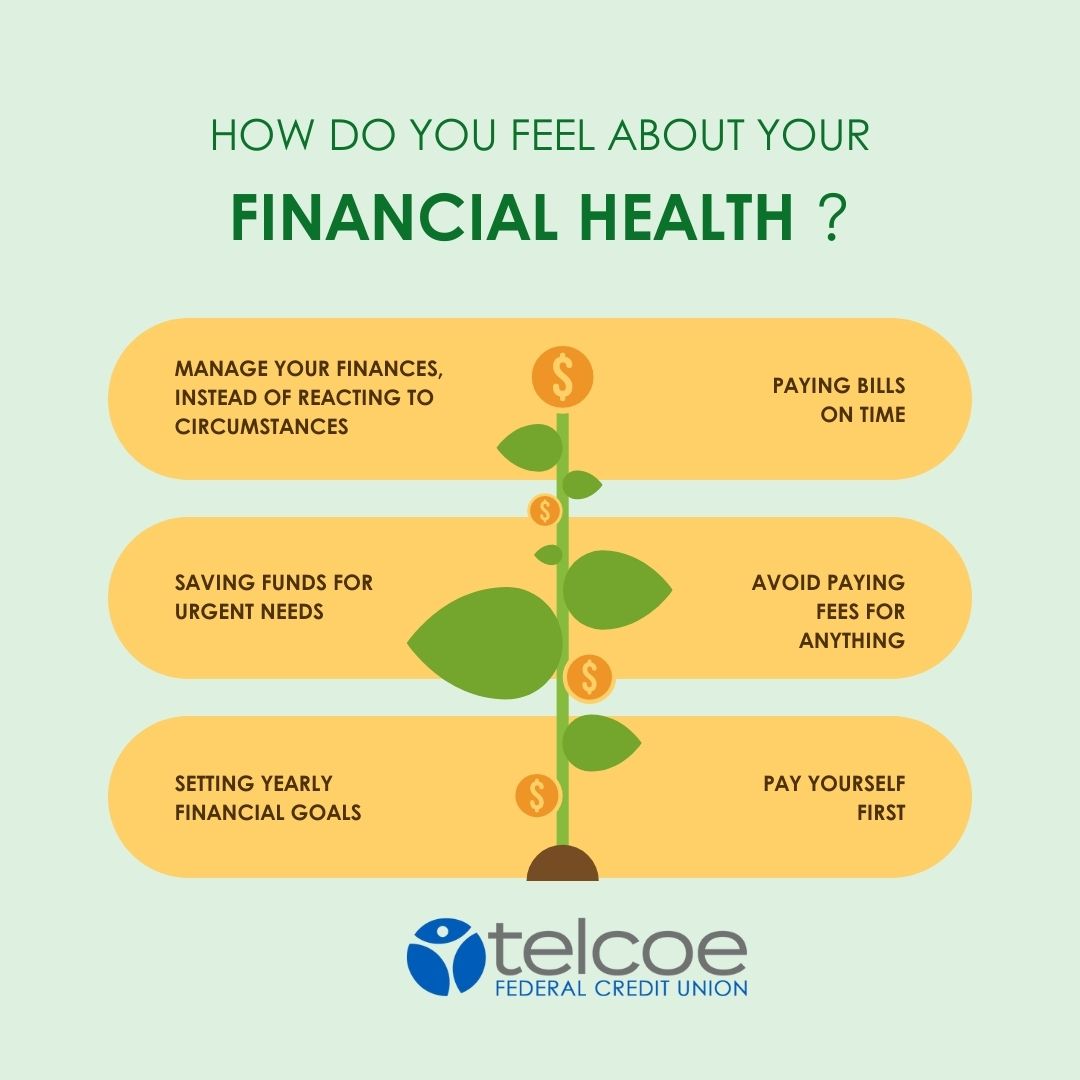

Choose Your Path to Financial Wellness

Wherever you are on your financial journey, we’re here to help you take the next step.

✔

PLAN

Get the tools you need to plan for retirement, build your savings, and feel more confident about the future.

✔

SAVE

Meet with a financial coach, set goals, and choose savings options that work for your lifestyle.

✔

SPEND

Take control of your day-to-day finances with accounts and tools that make managing money easier.

✔

BORROW

Find low-rate loan options and helpful resources to borrow smart and stay on track.

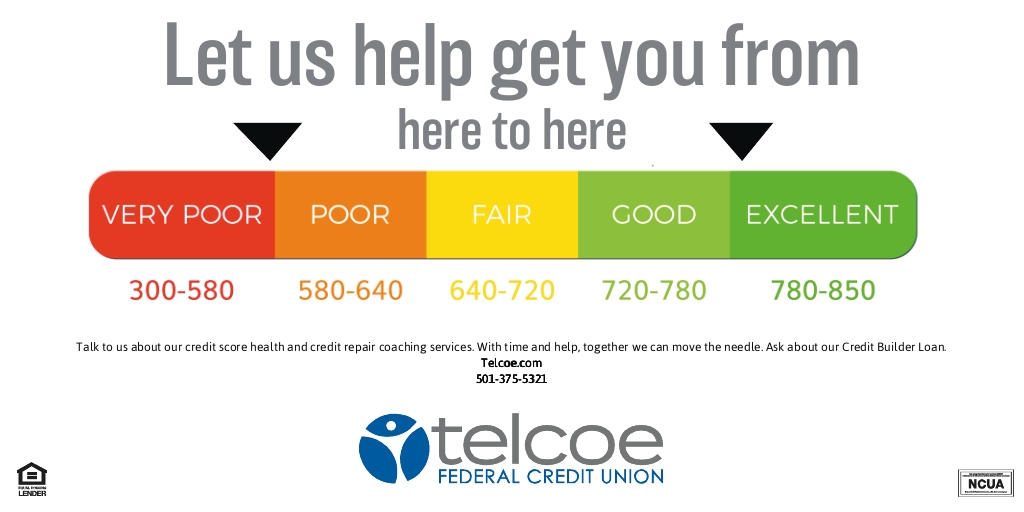

UNDERSTANDING YOUR CREDIT SCORE

We care about your financial wellness, and that includes your credit score. Understanding how it works is the first step toward improving it.

Your credit score helps lenders predict how likely you are to repay a loan on time, and it plays a big role in your loan approval and interest rate. This is called risk-based pricing: the higher your score, the better your rate.

There are three credit bureaus in the U.S: Equifax, Experian, and TransUnion. You can request a free copy of your credit report from each bureau once a year at www.annualcreditreport.com.

Scores may vary depending on the source. The score you see on Credit Karma or your credit card statement is often higher than what a lender sees, which can be confusing, but it’s normal.

Your score is based on:

- Bill payment history

- Unpaid debt balances

- Number and type of loan accounts open

- Age of loan accounts open

- Amount of available

credit card lines not used

STUDENT LOAN DEBT

If you are unsure of your next steps, contact GreenPath Financial Wellness to speak with a financial counselor. Telcoe members are able to contact Greenpath till 9 PM or even on Saturday for many types of financial coaching from a compassionate financial expert.

HIGH-RATE CREDIT CARD DEBT

The average credit card rate is currently over 20% APR. If you are feeling financial stress and ready to cut up the cards and find a way to pay off the debt at a much lower rate, Telcoe and our partner Greenpath can help. Give us a call to talk through the options that can save you thousands of dollars and allow you to sleep better.

How Telcoe Can Help Your Finances

GreenPath Partnership

Telcoe members can contact Greenpath as late as 9 PM or even on Saturday to obtain financial coaching, credit report review, etc.

Establish a Credit History

Build the credit history you have always wanted. Telcoe is

your financial partner for life.

Lower Your Rates

Save money by moving your current loans to Telcoe at a lower rate and repaying through payroll deduction. Get a savings quote.

Financial Wellness Resources FAQs

What is the highest credit score possible?

850 is the highest possible credit score. Achieving a score of 700+ should allow you to receive premium rates and pricing for home/auto insurance, etc. Greenpath offers a webinar on this topic -HERE

I feel overwhelmed, where should I even start?

You are not alone. If you are not actively putting money in a savings account each payday lets start there. We can open a Christmas Club savings account for free. You an start with just $1 per payday if your budget is tight. This small step is monumental in helping prioritize your money priorities. If you would like to talk through all options or meet in person please do reach out at 501-375-5321.

What is the highest-earning account offered by Telcoe Federal Credit Union?

Telcoe offers certificates of deposit with terms of 6 months to 5 years. Visit www.telcoe.com/rates to see the special terms and rates currently being offered. Telcoe also offers a Money market account for savers with at least $2500. This is a great account that allows you to add to it and make withdrawals (3 or fewer per month are FREE). It also pays an above-average dividend.

What vehicles can qualify for a Telcoe FCU auto refinance loan?

You can get auto refinancing for new and used cars or motorcycles that are 2018 or newer with fewer than 80,000 miles. It is worth sending the Vin#, mileage, payoff amount, rate now, payment now, and your estimated credit score to our Loan Professionals for a free savings quote.

How can I establish or rebuild my credit score with Telcoe?

Great question. Give our Telcoe Specialist a call. We can help review your current credit report and then offer you a Credit Builder Loan, a Secured MasterCard, and possibly additional services. Each individual's credit journey is unique so give us a call so we can help you meet your financial goals.

Can I sit down with a human at Telcoe?

Absolutely. Since 1950, we have been meeting our members in person and sitting down and spending time listening to your journey. We look forward to meeting you very soon. You will earn more on your savings, pay less on your loans, and have a financial partner for life with Telcoe.

My financial stress is growing quickly, can Telcoe help?

Yes. We can sit down, review your finances and help you find a plan to meet your financial goals. It can be scary and we have helped many members to overcome financial obstacles. Give us a call today to schedule an appointment. You can also use the budget worksheet to help prepare to meet in person.

Have Questions about Your Financial Wellness Benefits?

Additional Financial Wellness Resources

Read Our Blog for Tips and Tricks

Check Out These Bonus Resources

- Learn about Cash App Scams

- TrueCar Car Buying Service-Discounted Pricing

- GreenPath Financial Management

- Kelley Blue Book Vehicle Values-Get the Most on your Trade